- TAX WRITE OFFS FOR SMALL BUSINESS OWNERS SOFTWARE

- TAX WRITE OFFS FOR SMALL BUSINESS OWNERS OFFLINE

- TAX WRITE OFFS FOR SMALL BUSINESS OWNERS PROFESSIONAL

TAX WRITE OFFS FOR SMALL BUSINESS OWNERS PROFESSIONAL

Professional identity insurance premiumsĭepending on the type of business you run, and subject to certain limits, you can claim up to 20% of your profits as a tax deduction.

You can deduct insurance premiums incurred by your business: Payment processing costs for accepting cards.Incoming and outgoing wire transfer fees.Ongoing and one-off bank fees for business services.Your bank is likely to charge you for business services, and you’ll also pay a fee for accepting charge, credit, or debit cards. When you provide training to yourself or your staff, those costs can be deducted. Bad debts due to invoices that will not be paid.If you have taken out loans for your business, you can deduct the interest. Loan Interest and Bad Debt Tax Deductions Meals when traveling for business, although this may be limited to 50% of the cost.If you travel or stay away from home for business, those costs are deductible.

TAX WRITE OFFS FOR SMALL BUSINESS OWNERS OFFLINE

Offline advertising like billboards or newspaper ads. Online advertising like Google AdWords or social media paid ads.

You can deduct any money you spend on promoting your business. You can either track everything individually, or use the IRS mileage rates. If you use a vehicle in part or exclusively for your business, you can deduct those costs. You can claim costs for professional services like tax preparation or legal fees, and for paying freelancers or other contractors to complete work for your business.

Percentages of payroll or self-employment taxįreelance, Contractor, and Professional Tax Deductions.  Benefits paid to employees like bonuses and other areas. Medical premiums paid for employees like health or dental insurance. Employee expenses and taxes can be complex, so we recommend speaking to an accountant or tax preparer to understand what you can deduct. If you pay a salary to employees, then you can deduct some of those costs from your business revenue. Replacing lightbulbs and other consumables. Miscellaneous stationery like pens, pencils, staples, elastic bands, paperclips, etc. Specialized equipment not covered elsewhere.

Benefits paid to employees like bonuses and other areas. Medical premiums paid for employees like health or dental insurance. Employee expenses and taxes can be complex, so we recommend speaking to an accountant or tax preparer to understand what you can deduct. If you pay a salary to employees, then you can deduct some of those costs from your business revenue. Replacing lightbulbs and other consumables. Miscellaneous stationery like pens, pencils, staples, elastic bands, paperclips, etc. Specialized equipment not covered elsewhere. TAX WRITE OFFS FOR SMALL BUSINESS OWNERS SOFTWARE

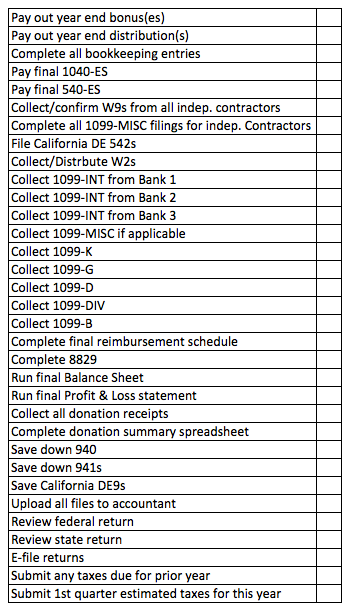

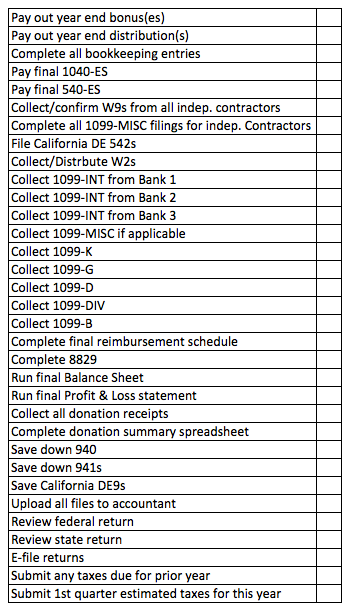

Purchase of software applications and programs. Shelves, filing cabinets, and storage units. You can make additional deductions on money you spend for your business office. You can claim a percentage of your mobile phone bill depending on how much you use your mobile phone for business. You cannot claim a telephone landline unless it is specifically dedicated to your business. The IRS also provides a simplified option for expensing home office costs. If you work from home, you can only deduct a proportion of your household bills, dependent upon the percentage of your home used for running your business. If you have a dedicated building for your office, you can deduct all of your business costs associated with the expenses your business incurs. These tax deductions include costs associated with renting a building for business, using part of your home as an office, utility bills, and other factors. Rent, Mortgage, and Utility Tax Deductions Speak to your tax preparer for more information. Note that some of the expenses listed below will need to be “ depreciated ” or expensed over several years. As always, check with your accountant or tax preparer if you have any questions or need clarification. We’ve created a checklist below of the most deductions you can claim for your small business. While the IRS does not specifically list what you can claim, they do state that if a cost you’ve incurred is “ordinary and necessary” to running your business, then you can deduct it. These deductions will reduce your profits, meaning that you will pay lower overall taxes. The great news? There are many expenses you can apply to your income to help alleviate your tax burden. The not-so-good news? Every business needs to file taxes.

0 kommentar(er)

0 kommentar(er)